Why It’s Okay To Rent Forever: Part 2

Owning a home is not a requirement to obtain financial security. This is a discussion of when it can be okay for investors to rent forever instead of straining their budgets to purchase a home. In this article, I will explore how to reach your personal financial goals while renting.

House Poor

The term house poor in this context refers to your housing costs taking up almost your entire budget, not leaving any room for discretionary spending or savings. A 2021 Bankrate study found that 64% of millennials have regrets about their home purchases and one of the biggest regrets was ongoing costs. Not only are mortgage interest rates much higher now than in recent history, but homeowners are also responsible for a lot of costs that renters don’t need to worry about. You must pay property taxes, get homeowner’s insurance, and plan for unexpected maintenance. Renters, for the most part, do not have significant surprise costs above and beyond rent. If the toilet breaks, renters call the landlord. If there’s mold, renters call the landlord. Homeowners do not have the luxury of passing maintenance costs on to someone else.

A house is also not a bank account. If you end up retiring and your home is your only asset, it can be difficult to monetize. People who skip retirement funding in favor of housing payments and hope to retire on the value of their home may be in for a surprise. Here are the ways to get money out of your house and the costs that could eat into your investment:

Outright Sale (often resulting in broker’s fees and taxes if you have significant appreciation).

Home Equity Line of Credit (requiring good credit and income to cover the increased repayment expenses).

Reverse Mortgage (often resulting in surrendering the accumulated equity in your home due to the compounding nature of the interest rates).

Since renting an equivalent home is often cheaper than owning it, you may be able to take being house poor off the table and invest your cash flow difference toward your long-term goals.

Choosing what to do with excess cash

When Investing Excess Cash Makes Sense

If you choose to invest excess cash flow in lieu of purchasing a home, I do want to caution you to be mindful of how you’re investing. We discussed in the last article that housing can be an effective inflation hedge, meaning that housing prices usually increase at a rate equal to or greater than that of inflation. So, if you’re choosing to invest excess funds in cash, CDs, money market accounts, treasury bills, or other very conservative investments, you may have been better off by investing in real estate instead.

It’s important to be mindful of your investment goals, time until you wish to access funds, and willingness to take on some portfolio risk. It’s also important to consider portfolio taxation. Investment returns over time can be impacted by taxation so choosing a tax-advantaged account such as a pre-tax or Roth investment may give more after-tax compounding returns versus a standard brokerage account.

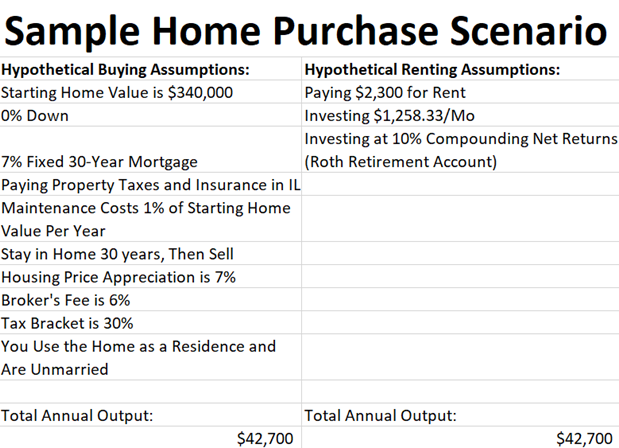

As I mentioned in part 1, it’s important to run the numbers for yourself (or have them ran for you) to see if renting or buying makes more sense for you and your financial goals. The hypothetical calculation of buying versus renting equivalent homes in Chicago below was addressed in part 1. Here, we’re looking at someone with an aggressive risk tolerance and a 30-year investment horizon. Here are the hypothetical assumptions:

Assumptions in Chicago buying versus renting scenario

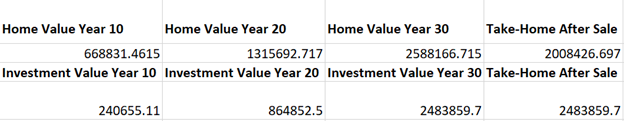

Using the hypothetical assumptions above and a compounding return calculator, we end up with $2,008,429.70 from the home sale and $2,483,859.70 from the investment account after 30 years:

Home versus investment values after 10, 20, 30 years, and sale.

IMPORTANT: All figures shown -- including the 10% compounding net returns shown for this example, which are not reflective of the performance of any particular investment, account, or financial product – are entirely hypothetical and presented for illustrative purposes only. Investing involves risk, including loss of principal investment. Individual experiences and outcomes will vary, possibly in a substantial way.

Major Factors That Affect The Calculations

Here are some changes to the hypothetical assumptions that would make renting and investing more attractive than illustrated:

Factoring in a down payment.

Factoring in maintenance and property insurance costs as the home value increases.

Increasing the mortgage interest rate.

Lowering housing price appreciation to longer term historical averages.

Assuming the investor sells and moves before the term of the mortgage has ended.

Assuming tax rates are higher in the future.

Assuming the broker fee is higher in the future.

Assuming you do not use the home as a residence.

Increasing equity returns to longer term historical averages.

Here are some changes to the hypothetical assumptions that would make buying more attractive than illustrated:

Increasing housing price appreciation.

Lowering the mortgage interest rate.

Lowering the assumed investment returns.

Adding rent inflation and leaving property taxes and maintenance costs as is.

Removing tax advantages for the investment portfolio.

Assuming the homeowner is married.

Assuming taxes in the future would be lower.

Assuming the homeowner passes away while owning the property and their heirs receive a step-up in cost basis.

Conclusion

Many investors are faced with the decision to buy a home versus rent a home. Consider the factors discussed in this article as you decide when investing excess cash and continuing to rent makes sense, and how to weigh the variables to see if renting or owning make more sense for you and your financial goals.

This article was originally published by me on Forbes.

This informational and educational article does not offer or constitute, and should not be relied upon, as real estate, mortgage, or financial advice. Your unique needs, goals and circumstances require the individualized attention of your own qualified professionals whose advice and services will prevail over any information provided in this article. Equitable Advisors, LLC and its associates and affiliates do not provide real estate or mortgage tax or legal advice or services. Equitable Advisors, LLC (Equitable Financial Advisors in MI and TN) and its affiliates do not endorse, approve, or make any representations as to the accuracy, completeness, or appropriateness of any part of any content linked to from this article.

Cicely Jones (CA Insurance Lic. #: 0K81625) offers securities through Equitable Advisors, LLC (NY, NY 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN) and offers annuity and insurance products through Equitable Network, LLC, which conducts business in California as Equitable Network Insurance Agency of California, LLC). Financial Professionals may transact business and/or respond to inquiries only in state(s) in which they are properly qualified. Any compensation that Ms. Jones may receive for the publication of this article is earned separate from, and entirely outside of her capacities with, Equitable Advisors, LLC and Equitable Network, LLC (Equitable Network Insurance Agency of California, LLC). AGE-5957923.1(10/23)(exp.10/25)