When To Use Roth Or Pretax Retirement Accounts

You might have heard that retirement savings accounts come with tax benefits. However, you may not understand the specifics or what to expect many years down the road when you withdraw your funds. This is a discussion of Roth and pretax retirement savings, the impact of taxes, and when each type of account may be appropriate.

How Taxation Works In A Nonretirement Investment

Nonretirement investments are not subject to ordinary income taxes like the money you earn when you receive a paycheck.

There are three ways you can be taxed on your portfolio:

When you save in an investment

When the investment grows

When you take the investment out

Money in a nonretirement account goes into investments after income taxes. As the money grows, you pay taxes on trades in your account, dividends, and interest that can be automatically generated from your portfolio. If the value of your portfolio increases over time, you then pay taxes on your portfolio gains in the form of capital gains taxation when you sell your investments to use the money.

Roth and pretax are terms that refer to the tax wrappers around the investments you hold. They can be used to refer to 401(k)s, IRAs, and many more vehicles. The main advantage of both Roth and pretax investments is that, when used correctly, they avoid two out of the three situations where you could be taxed. Therefore, they are considered tax-advantaged accounts.

Roth

Roth investments, like Roth IRAs and Roth 401(k)s, have been gaining immense popularity recently, and with good reason. Roth treatment allows the investor to:

Save money after taxes

Defer taxes while growing the investment

Access the investment tax-free for qualified distributions

So, when you save in a Roth investment, you do not receive any current tax deductions. All the tax advantages will occur over the years of investing and distributing funds. One key advantage is that when you look at the balance of a Roth retirement account, what you see is what you get. If you have $200,000 in Roth investments and decide to take them all out at age 60, $200,000 is what hits your bank account.

Pretax

Pretax retirement accounts, like traditional IRAs and pretax 401(k)s, are the oldest and most common types of retirement accounts. This is how they work:

Save money before it gets taxed

Defer taxes while growing the investment

Pay taxes on the money as you distribute it

When you save in a pre-tax investment, you receive a dollar-for-dollar tax-deduction for the amount you saved. For example, if you make $100,000 and save $10,000 pretax dollars, your taxable income is reduced to $90,000.

Because the money in a pretax retirement account has yet to be taxed, it’s critical that investors look at their portfolio balances with a grain of salt. If you have $200,000 in a pretax retirement account, that is not the actual dollar amount that would hit your bank upon distributions. You’d need to reduce your balance by your expected tax rate to have an idea of the net amount you’d receive.

If tax rates remained the exact same throughout an investor’s life, it would make no difference whether an investor saves with a pretax or Roth retirement account.

Rules Around Distributions

It’s important to understand how to distribute these assets to reap the tax advantages. Retirement accounts are not intended to be bank accounts or emergency reserves. The IRS does not take kindly to people using these accounts for purposes other than funding retirement, with some small exceptions. Distributions from retirement accounts can occur without penalties in the following events:

Reaching the age of 59 ½

Qualified early retirement for government employees

Dying and passing investments to a beneficiary

Meeting the Social Security definition of disability

Qualified financial hardship

Qualified domestic relations orders (court decrees due to divorce)

If you make distributions without qualifying under one of the listed reasons, the IRS imposes a 10% penalty, plus ordinary income taxes. Here’s what that looks like for Roth versus pre-tax accounts, if both parties contributed $100,000 and had $100,000 in growth assuming a flat tax rate of 30%:

Roth (taxes and penalties are only applied to growth in the account): $100,000 + $100,000 X (1-(.3+.1)) = $160,000

Pretax (taxes and penalties are applied to the full amount in the account): $200,000 X (1-(.3+.1) = $120,000

Either way you slice it, nonqualified distributions take a significant chunk out of your investment. To avoid the need to dip into your retirement assets, make sure you have an adequate emergency fund on hand.

History Of Marginal Tax Rates

Most investors I speak with dislike taxes and want to avoid them as much as possible. If you’re one of these people, it may surprise you to learn that Americans are currently experiencing relatively low marginal tax rates historically. In fact, the U.S.’ highest marginal federal tax rate today is 37% and the highest it’s ever been was 94% in 1944 and 1945.

Investors in the United States are under a marginal tax system. That means that you don’t uniformly pay the same amount of taxes on every dollar that comes in. Your marginal tax rate is the taxation amount that applies to the next dollar you earn. So, if you were in the 94% marginal tax bracket in 1944, you’d get to keep 6 cents on that next dollar earned. This would provide a large incentive to gain current tax deductions.

I don’t dare make predictions of what tax rates will be in the future. There are too many moving parts and outside influences to accurately predict that. However, when I look at federal debt levels, declining population growth, and underfunded social obligations, I become nervous about the future of tax rates.

When To Use Each

The golden question is: Which tax wrapper will benefit you most? Because we don’t have a crystal ball, there’s no way of saying for certain. We can only guess. I personally put 100% of my retirement savings toward Roth investments because I’d rather pay a known amount of taxes today than an unknown amount tomorrow.

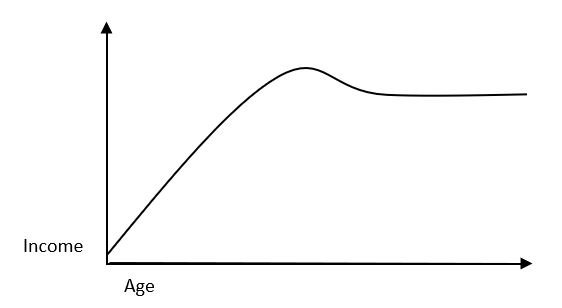

Oftentimes, over the course of our lives, we start at a relatively low income early in our career, hit peak income in our 40s and 50s, and retire on an income lower than the peak income years, as seen below:

Following this curve, you may choose to invest in Roth investments early in your career because you predict your future taxes will be higher. In those peak income years, you may opt for pretax investments to get the income tax deductions today because you assume you’re in the highest tax rate you’ll ever be in.

Not everyone follows this income curve and tax laws are subject to change. So, if you want tailored advice, it’s important to work with your tax advisor and financial advisor to see which option might be right for you today.

This article was originally published by me on Forbes.

This informational and educational article does not offer or constitute, and should not be relied upon as tax, legal or financial advice. Your unique needs, goals and circumstances require the individualized attention of your own tax and financial professionals whose advice and services will prevail over any information provided in this article. Equitable Advisors, LLC and its associates and affiliates do not provide tax or legal advice or services. Equitable Advisors, LLC (Equitable Financial Advisors in MI and TN) and its affiliates do not endorse, approve or make any representations as to the accuracy, completeness or appropriateness of any part of any content linked to from this article.

Cicely Jones (CA Insurance Lic. #: 0K81625) offers securities through Equitable Advisors, LLC (NY, NY 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN) and offers annuity and insurance products through Equitable Network, LLC, which conducts business in California as Equitable Network Insurance Agency of California, LLC). Financial Professionals may transact business and/or respond to inquiries only in state(s) in which they are properly qualified. Any compensation that Ms. Jones may receive for the publication of this article is earned separate from, and entirely outside of her capacities with, Equitable Advisors, LLC and Equitable Network, LLC (Equitable Network Insurance Agency of California, LLC). AGE-6417195.1 (02/24)(exp.02/26)